How to make 50 pips a day in forex

Yes, It is possible to make 50 pips a day in forex market.

To know about how to make 50 pips a day in forex trading is challenging but achievable with the right knowledge, mastering the different strategies, and mindset. It requires knowledge of technical analysis, Proper Risk management, dedication, continuous learning. By focusing on building a solid foundation, developing a clear trading strategy, and practicing with discipline, you can work towards your goal of consistent profitability in forex trading.

Now, when you want to make 50 pips a day it is difficult in starting. But proper planning, Using different strategy and mindset it is absolutely achievable.

What is pip?

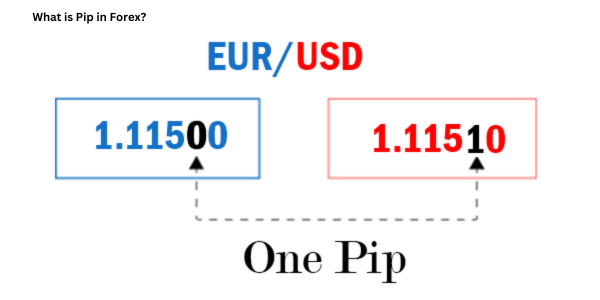

To get knowledge about how to make 50 pips a day in forex first understand it by discussing what is the pip. A pip, which is short for “percentage in point” in forex trading, is the smallest possible price movement that a currency exchange rate. For example, if the EUR/USD pair moves from 1.1500 to 1.1501, it has moved one pip. One pip is equal to 0.0001 for the majority of currency pairs, with the exception of those involving the Japanese yen, where one pip is equal to 0.01.

Important of pips

Pips play a important role to get knowledge about how to make 50 pips a day in forex and measuring profit and loss in forex trading, acting as the basic unit of measurement for price movements. Here’s why they are important:

Precision in Measurement: Pips provide a standardized way to quantify changes in currency prices. They allow traders to accurately gauge how much the value of a currency pair has fluctuated over a given period. For example, if the USD/JPY pair moves from 110.00 to 110.50, it indicates a movement of 50 pips.

Calculating Profits and Losses: Profit and loss calculations in forex trading are directly tied to pips. When a trader enters a position, whether buying (going long) or selling (going short), the difference in pips between the entry and exit points determines the profit or loss. For instance, if a trader buys EUR/USD at 1.1200 and sells at 1.1250, with each pip worth $10, they would have made a profit of 50 pips x $10 = $500.

Risk Management

Understanding pips is essential for effective risk management. Traders use pips to set stop-loss orders, which are predetermined levels where they will exit a trade to limit potential losses. By calculating the distance in pips between the entry point and stop-loss level, traders can control risk exposure relative to their account size.

In essence, pips are more than just numbers; they are critical tools that enable traders to quantify, manage, and optimize their trading activities in the dynamic forex market. Mastering the concept of pips is fundamental for anyone aspiring to navigate and succeed in currency trading.

Developing a Strategy for 50 Pips a Day

Technical Analysis: Use technical indicators (e.g., moving averages, RSI, MACD) to identify potential entry and exit points. Look for different chart patterns and trends that suggest trading opportunities.

Time Frame Selection: Choose a time frame that aligns with your trading style and strategy. Short-term traders may focus on lower time frames (e.g., 5-minute or 15-minute charts) to capture quick moves, while swing traders may prefer higher time frames (e.g., 1-hour or daily charts) for more significant price swings.

Identifying High Probability Setups: Look for high-probability trade setups where the risk-to-reward ratio is favorable. This involves identifying support and resistance levels, breakouts, and reversal patterns.

Identifying Different Types of Chart Pattern

Chart patterns play a crucial role in analyzing market trends and predicting future price movements. They are formed by the movement of prices.

- Head and Shoulders

- Double Top/Bottom

- Ascending Triangle

- Descending Triangle

- Symmetrical Triangle

- Flag and Pole Pattern

Scalping: Scalping can generate profits swiftly, taking advantage of numbers of small price movements throughout the trading day.

Understanding Scalping:

Scalping is a trading technique where traders aim to profit from small price changes. Unlike traditional trading methods that focus on long-term trends, scalping targets short-term opportunities, often holding positions for just a few seconds to a few minutes. This strategy requires traders to be highly disciplined and focused, as they must react swiftly to market fluctuations.

Key Elements of Scalping:

Choosing the Right Broker: Since scalping involves frequent trades, it’s crucial to select a broker with tight spreads and low commissions. Execution speed is also vital, so opt for a broker known for fast order execution.

Selecting Currency Pairs: Not all currency pairs are suitable for scalping. Major pairs like EUR/USD, GBP/USD, and USD/JPY are popular choices due to their liquidity and tight spreads, making them ideal for quick trades.

Timing Your Trades: Scalpers often trade during the most active sessions when market liquidity is high. The London and New York sessions overlap typically present the best opportunities, as trading volumes increase, leading to tighter spreads.

Effective Scalping Strategies:

1-Minute Scalping: This strategy involves placing frequent trades based on short-term price fluctuations. Traders use technical indicators such as moving averages, Bollinger Bands, and the Relative Strength Index (RSI) to identify entry and exit points quickly.

Scalping Breakouts: Traders monitor support and resistance levels, waiting for a breakout. Once a breakout occurs with strong momentum, they enter a trade in the direction of the breakout, aiming to capture rapid price movements.

News Scalping: This strategy involves trading around economic news releases, where price volatility tends to spike. Traders anticipate market reactions to the news and capitalize on short-term price movements.

Risk Management

Scalping can be highly profitable, but it’s also risky due to the frequency of trades and quick profit targets. Effective risk management is essential to protect your capital.

- Set tight stop-loss orders to minimize losses.

- Use proper position sizing to limit the impact of individual trades on your overall account.

- Avoid over-leveraging, as it can amplify both profits and losses.

Advantages and Disadvantages of Scalping

Scalping is the most popular trading strategy in the forex market, offers the both unique advantages and disadvantages traders should carefully consider.

Advantages:

Quick Profits: Scalping allows traders to capitalize on small price movements, potentially generating quick profits within short time frames.

High Trading Frequency: Scalpers make numerous trades in a day, which can lead to increased opportunities to profit from volatile market conditions.

Reduced Exposure: Since positions are held for short periods, scalpers are less exposed to overnight risks such as news events or market gaps.

Disadvantages:

High Transaction Costs: Frequent trading results in higher transaction costs due to spreads and commissions, which can eat into profits.

Intense Monitoring: Scalping requires constant attention to the markets and quick decision-making, which may not be suitable for all traders.

Emotional Stress: Rapid trading can lead to emotional stress and fatigue, affecting decision-making and overall trading performance.

Practicing with Demo Accounts

Utilize demo accounts to practice your trading strategies without risking real capital. This allows you to refine your approach, gain confidence in your trading decisions, and identify areas for improvement.

Conclusion:

Whether you’re a novice trader looking to explore different trading styles or an experienced investor seeking to diversify your portfolio, mastering scalping can enhance your trading skills and unlock new opportunities in the forex market.

Start small, stay focused, and continuously educate yourself on market trends and trading techniques. With dedication and perseverance, you can navigate the complexities of scalping and thrive in the dynamic world of forex trading.